Proclaiming that he believes U.S. religious freedom is "under threat," President Donald Trump vowed Thursday to repeal a rarely enforced IRS rule that indicates pastors who endorse political candidates from the pulpit risk losing their tax-exempt status.

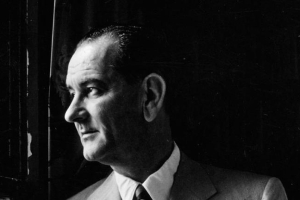

The rule, named after then-Sen. Lyndon Johnson, has been in place since 1954, but it is very rare for a church to actually be penalized. While some conservative Christians may like to see it abolished, others, especially younger U.S. citizens, confirm they support a clear separation of church and politics. Although it was considered uncontroversial at the time, in recent years, many Republicans have sought to repeal it, arguing that it restricts the free speech rights of churches and other religious groups.

"I will get rid of and totally destroy the Johnson Amendment and allow our representatives of faith to speak freely and without fear of retribution," Trump said during remarks at the National Prayer Breakfast held in Washington, D.C. for approximately 3,000 attendees.

Trump did not detail how he might abandon the IRS rule, according to Associated Press. He previously pledged to do away with it, though, as part of his extensive outreach efforts to religious conservatives, a group that took a long time to warm to his candidacy. Conservatives have argued the rule violates the protections of free speech and free exercise that the First Amendment extends to houses of worship. Courts have not agreed.

Repeal does not appear to have widespread public support, reports AP. Eight in 10 Americans said it was inappropriate for pastors to endorse a candidate in church in a poll released last September by Lifeway Research, a religious survey firm based in Nashville, Tenn.

The president made no mention at the prayer breakfast of other steps he may take, saying only that religious freedom is a "sacred right."

When Johnson was a senator from Texas, he introduced the measure as an amendment to the tax code in 1954, reports The New York Times: Like many things Johnson did, the goal was to bludgeon a political opponent, in this case a rival in a primary who had the backing of nonprofit groups that were campaigning against him by suggesting he was a communist. Though there was no church involved, according to PolitiFact, churches were covered by the bill as well.

Jerry Falwell Jr., evangelical leader, Liberty University president and Trump supporter, said eliminating the rule would "create a huge revolution for conservative Christians and for free speech."

In recent years, Alliance Defending Freedom representatives have attempted to challenge the Johnson Amendment through the Pulpit Freedom Initiative, which urges Protestant ministers to violate the statute in protest. The ADF also contends the amendment violates First Amendment rights.

The Internal Revenue Service website elaborates upon this prohibition as follows:

"Under the Internal Revenue Code, all section 501(c)(3) organizations are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. Contributions to political campaign funds or public statements of position (verbal or written) made on behalf of the organization in favor of or in opposition to any candidate for public office clearly violate the prohibition against political campaign activity. Violating this prohibition may result in denial or revocation of tax-exempt status and the imposition of certain excise taxes.

Certain activities or expenditures may not be prohibited depending on the facts and circumstances. For example, certain voter education activities (including presenting public forums and publishing voter education guides) conducted in a non-partisan manner do not constitute prohibited political campaign activity. In addition, other activities intended to encourage people to participate in the electoral process, such as voter registration and get-out-the-vote drives, would not be prohibited political campaign activity if conducted in a non-partisan manner.

On the other hand, voter education or registration activities with evidence of bias that (a) would favor one candidate over another; (b) oppose a candidate in some manner; or (c) have the effect of favoring a candidate or group of candidates, will constitute prohibited participation or intervention."

The Internal Revenue Service provides resources to exempt organizations and the public to help them understand the prohibition. As part of its examination program, the IRS also monitors whether organizations are complying with the prohibition.

LGF"/>

LGF"/>